5. Help with managing your money

Advances

If you have made a Universal Credit claim but are unable to manage until your first payment, you may be able to get a Universal Credit advance.

The amount you can borrow will be up to your first estimated Universal Credit monthly payment.

You will need to pay back your advance a bit at a time from your future Universal Credit payments. You will usually pay your advance back over a 12 month period.

To apply for an advance payment you’ll need to:

- let the Department for Work and Pensions know why you need the advance

- provide your bank details so that the money can be paid if an advance is agreed

- show that you can pay it back

- agree to pay it back

You will usually be told if you can get an advance on the same day that you apply for it.

You can apply for an advance payment in your online account. If you are unable to apply online, you should contact your work coach through your journal if possible, but if not you can call the Universal Credit helpline.

You can only apply for an advance online if you are within your first Universal Credit assessment period, and your identity has been verified online or over the telephone by someone from DWP.

You may be able to get an advance after your first assessment period if you have had a change of circumstances that means you will get a larger Universal Credit payment, but you haven’t yet received that increased amount. If you are in this situation you can apply for an advance by calling the helpline.

If you are experiencing severe financial difficulties, you may be able to pause your advance repayments for up to 3 months. This is only available in exceptional circumstances. If you think you need to pause your advance repayments you should contact your work coach using your online account. If you are not able to access your online account you can call the helpline.

Read more about getting a Universal Credit advance

Never give out personal or financial information. The Department for Work and Pensions will never approach you in the street or ask for personal details over social media. Listen to your instincts – if something feels wrong then it’s usually right to question it. If someone offers you a low cost loan from the government they may be trying to steal your identity. If you believe you have been targeted by fraudsters, get in touch with Action Fraud on 0300 123 2040 or online at www.actionfraud.police.uk

Run-on payments

From 22 July 2020, if you are receiving income-based JSA, income-related ESA or Income Support, and either choose to claim Universal Credit, or a change in your circumstances means you need to claim Universal Credit instead, you may receive up to an additional 2 weeks’ worth of those payments

Managing your money

Universal Credit is paid as a single monthly payment. It will usually be up to you to pay your rent and bills for the month using this money.

You may be used to managing your money on a monthly basis, but if not you will need to make sure you can pay all your bills from this single payment. In most cases this will include paying your own rent and other housing costs.

Budgeting support

A range of support services are available to help you budget. You can talk to your work coach about the type of help you might need. Options could include an online service, advice sessions by phone, or face-to-face support.

If you want some help with managing your money, you can use the online Money Manager. This is a digital tool created by the Money Advice Service, which offers personalised money management advice.

See Universal Credit: help with managing your money for more advice and information.

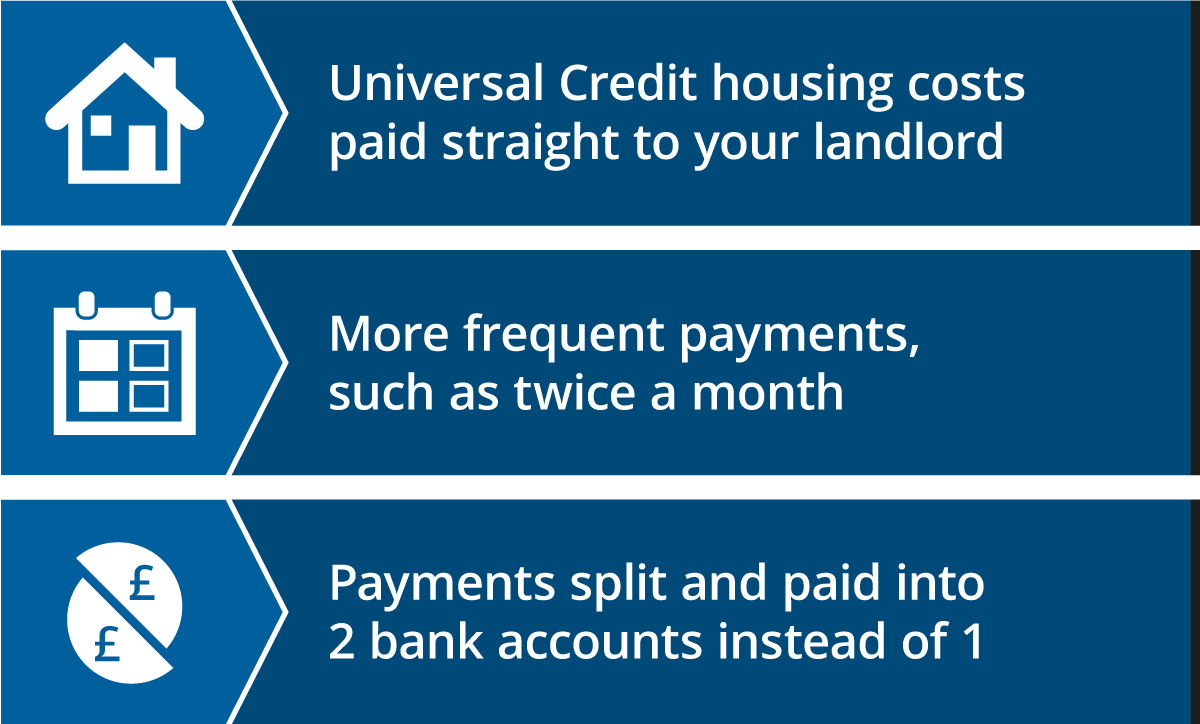

Alternative Payment Arrangements

If you are having trouble managing your money whilst on Universal Credit you may be able to use an Alternative Payment Arrangement. These are changes to the way that Universal Credit is paid that can help you to pay your bills and living costs.

Alternative Payment Arrangements can be one or more of:

- Universal Credit housing costs paid straight to your landlord

- more frequent payments, such as twice a month

- payments split and paid into 2 bank accounts instead of one

Alternative Payment Arrangements are kept under review to make sure they are providing the right support. When one is agreed you may also be asked to take steps to help you manage your money, such as getting budgeting advice, and you will agree a review date. The purpose of that review is to decide if an Alternative Payment Arrangement is still the best approach for you.

You can ask for an Alternative Payment Arrangement at any time from your new claim interview onwards, although one can only be put in place following the end of your first assessment period. Speak to your work coach or call the helpline for more information.